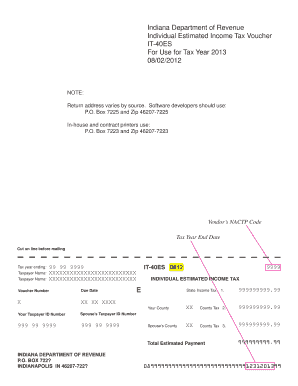

indiana tax payment voucher

Box 6102 Indianapolis IN 46206-6102 Form ES-40 State Form 46005 R22 12-21 Spouses Social Security Number. The fee for using this service is 1 They also list a credit card option but nothing I see uses a voucher.

Fillable Online Individual Estimated Income Tax Voucher Fax Email Print Pdffiller

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

. To pay by using your American Express Card Discover Card MasterCard or VISA call 1-800- 2-PAY TAX 1-800-272-9829. Since the change in your tax situation is not expected to repeat during the current year the estimated tax payments would not apply they are not a requirement just a. Claim a gambling loss on my Indiana return.

INTIME offers a quick safe and secure way to submit payments at your convenience. Write your Social Security number on the check or money order. Indiana Department of Revenue PO.

Find Indiana tax forms. Instead all withholding payments will be remitted with Form IT-41ES Fiduciary Payment Voucher. Fiduciary representatives may use the IT-41ES Fiduciary Payment Voucher to make a payment for a trust or an estate.

Why do the IT-65 and IT-20S have both a Total amount of pass-through withholding line and an IT-6WTH line. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Did you know that DORs online e-services portal INTIME allows individuals to pay their estimated taxes owed to DOR or view their payment history 247.

15 2022 4th Installment payment due Jan. Please check the appropriate box on the front of this form to let us know if you are making an estimated extension or composite payment. Form IT-41ES Indiana Department of Revenue Fiduciary Payment Voucher Estimated Tax Extension or Composite Payment State Form 50217 R11 8-21 For the calendar year or fiscal year beginning and ending Federal Employer Identification Number of Trust or Estate Name of Trust or Estate Name and Title of Fiduciary Trustee Executor Personal Representative.

Indiana payment vouchers No you are not required to pay the estimated tax vouchers for 2017 which were generated to assist with tax planning and avoiding tax penalties for the current year. To pay by credit card you may make your estimated tax payment online. Download or print the 2021 Indiana Estimated Tax Payment Voucher 2021 and other income tax forms from the Indiana Department of Revenue.

Information about Form 1040-V Payment Voucher including recent updates related forms and instructions on how to file. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. Pay the amount due on or before the installment due date.

Download or print the 2021 Indiana Estimated Tax Payment Voucher 2021 and other income tax forms from the Indiana Department of Revenue. Submit this statement with your check or money order for any balance due on the Amount you owe line. Indiana - Printing the Post Filing Coupon PFC Payment Voucher.

Indiana estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. To pay your taxes online or for more.

Know when I will receive my tax refund. The state return should be at the bottom of the federal PDF file. If you expect to receive a refund there is nothing to mail and the PFC will not print This form must accompany any payment you make to the Indiana Department of Revenue.

Have more time to file my taxes and I think I will owe the Department. Estimated payments may also be made online through Indianas INTIME website. Pay my tax bill in installments.

To pay go to wwwingovdor4340htm and follow the step-by-step instruc- tions. 1st Installment payment due April 18 2022 2nd Installment payment due June 15 2022 3rd Installment payment due Sept. IT-41 Fiduciary Income Tax Return Instructions.

If you owe Indiana state taxes a post filing coupon PFC will print with your return. Mail your 2021 tax return payment and Form 1040-V to the address shown on the back that applies to you. 17 2023 Mail entire form and payment to.

All payments must be made with US. You will be told what the fee is and you will have the option to either cancel or continue the credit card transaction. Indiana Form ES-40 Estimated Tax Payment.

Indiana Department of Revenue PO. For the 2022 tax year estimated tax payments are due quarterly on the following dates. Indiana Form ES-40 Estimated Tax Payment.

Indiana has a flat state income tax of 323 which is administered by the Indiana Department of RevenueTaxFormFinder provides printable PDF copies of 70 current Indiana income tax forms. Fill in the form save the file print and mail to the Indiana Department of Revenue. The current tax year is 2021 and most states will release updated tax.

You can get a copy of your federal state tax return and all of their accompanying forms worksheets payment vouchers etc by following the directions below. Write your Social Security number on the check or money order. Paying online is convenient secure and helps make sure we get your payments on time.

You can find your amount due and pay online using the intimedoringov electronic payment system. You will receive a confirmation number and should keep this with your tax filling records. Enclose your check or money order made payable to the Indiana Department of Revenue.

Pay the amount due on or before the installment due date. 23 rows Page one of the Indiana Form ES-40 file is the fillable voucher for the 2021 tax year. Estimated Payments Indiana does not require trusts and estates to make estimated payments.

For further information consult Income Tax Information Bulletins 1 and 72 at wwwingovdor3650htm. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. Take the renters deduction.

Page one of the Indiana Form ES-40 file is the fillable voucher for the 2021 tax year. Enclose your check or money order made payable to the Indiana Department of Revenue. All payments must be made with US.

You can pay using either of the following electronic payment methods. The credit will be reflected on the Schedule IN K-1 for each beneficiary. A convenience fee will be charged by the credit card processor based on the amount you are paying.

The IT-6WTH is a payment voucher that should be submitted to the Indiana Department of Revenue DOR only when there is a remittance with the voucher. To pay by credit card you may make an estimated tax payment online. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check.

How To Pay Electronically.

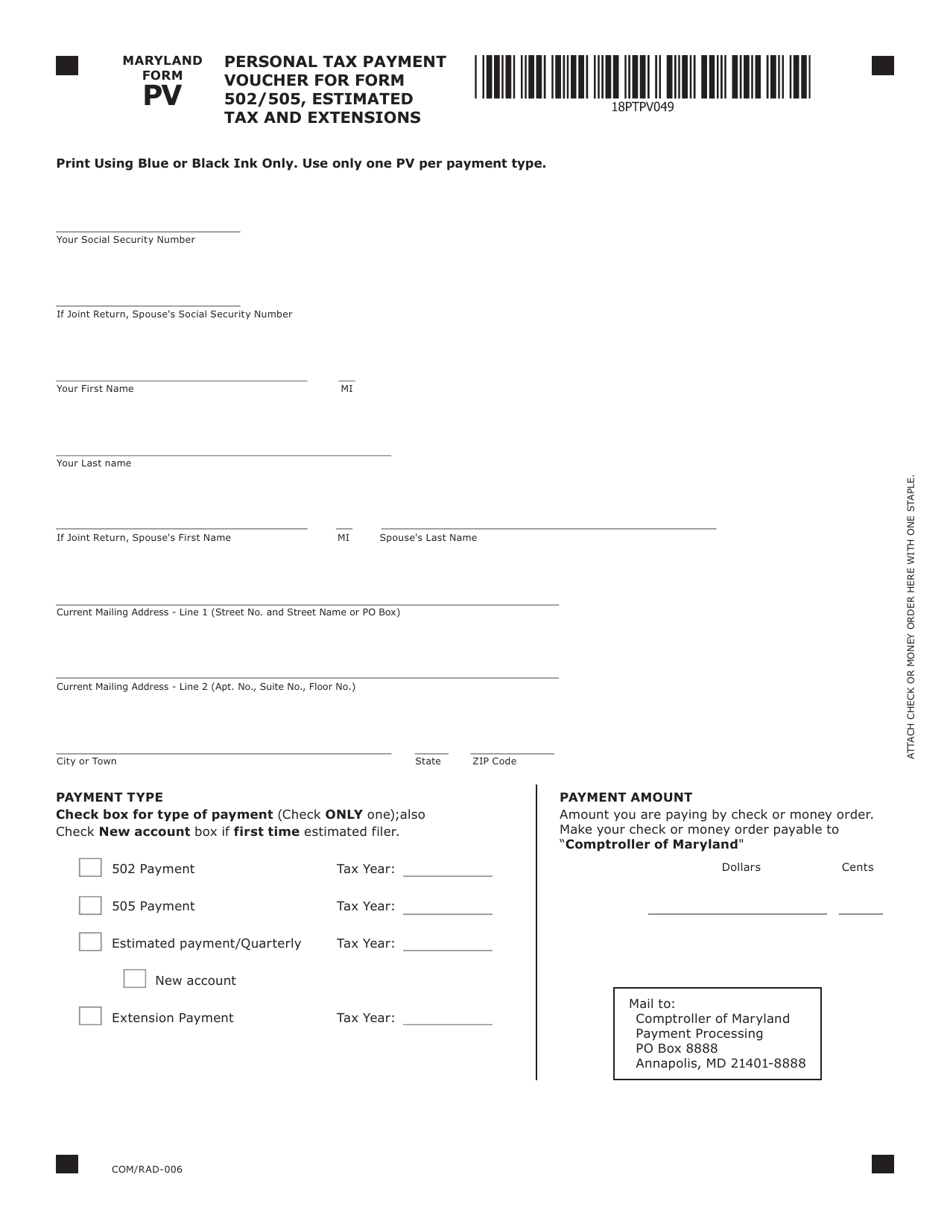

Maryland Form Pv Com Rad 006 Download Fillable Pdf Or Fill Online Personal Tax Payment Voucher For Form 502 505 Estimated Tax And Extensions Maryland Templateroller

Get Our Example Of Bill For Services Rendered Template For Free Invoice Template Word Create Invoice Invoice Template

Explore Our Image Of Bank Payment Voucher Template Payment Voucher Templates

Our Annual Chili S Fundraiser Begins This Wednesday June 1st Print Out The Voucher And Make Plans To Dine There Soon Fundraising Voucher Print

Unemployed People Listen Up How To Pay Quarterly Taxes I Pick Up Pennies

Eufy Security Floodlight Camera 1080p No Monthly Fees 2500 Lumens 99 99 With Voucher Sold By Ankerd Basic Business Plan Dsl Internet American Express Business

Browse Our Example Of Cash Payment Voucher Template For Free Voucher Template Word Voucher Templates

Get Our Sample Of Apartment Rental Receipt Template Receipt Template Spreadsheet Template Templates

Our Annual Chili S Fundraiser Begins This Wednesday June 1st Print Out The Voucher And Make Plans To Dine There Soon Fundraising Voucher Print

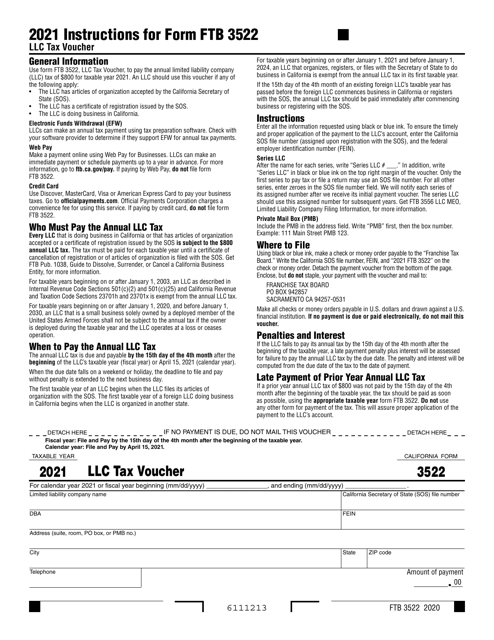

Form Ftb3522 Download Fillable Pdf Or Fill Online Llc Tax Voucher 2021 California Templateroller

Form 1 Es Download Printable Pdf Or Fill Online Estimated Tax Payment Voucher 2021 Massachusetts Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Templateroller

Browse Our Example Of Cash Payment Voucher Template For Free Voucher Template Word Voucher Templates

Form Es 40 2013 Estimated Tax Payment Voucher

Browse Our Sample Of Dividend Payment Voucher Template Dividend Templates Voucher

State Returns Estimated Tax Vouchers Direct Debit

Get Our Example Of Subcontractor Pay Stub Template Best Templates Professional Templates Independent Contractor